Money, Money, Money!

We all seem to struggle with it, and we just can’t seem to stretch it until the next pay day!

I am sure you have heard about the word “Budget” but have never actually sat down to ponder on it for more than 5 minutes.

So, here’s a little definition, (thanks to Google of course!):

- an estimate of income and expenditure for a set period of time.

"keep within the household budget"

synonyms: | financial plan, financial estimate, financial blueprint, prediction of revenue and expenditure |

So, in plain English… you need to draw up a plan on how to spend your money more effectively, and obviously have money left at the end of the month.

Now how to start a budget? Of course, you would need the following on hand:

- Your Income figure (you get this off your payslip

- List of your fixed debit orders that go off monthly (check your bank statement for these amounts, they would normally go off on the same date and be the same amount)

- Are there any planned events for that month? (write them down, as they tend to bite you in the end as you might have forgotten about it)

- Any planned monthly variable expenses, such as petrol, groceries, school fees (these figures might be different every month)

Now you can draw up your budget. You can either do this on Excel, or if you are not familiar with excel, you can simply do it on paper.

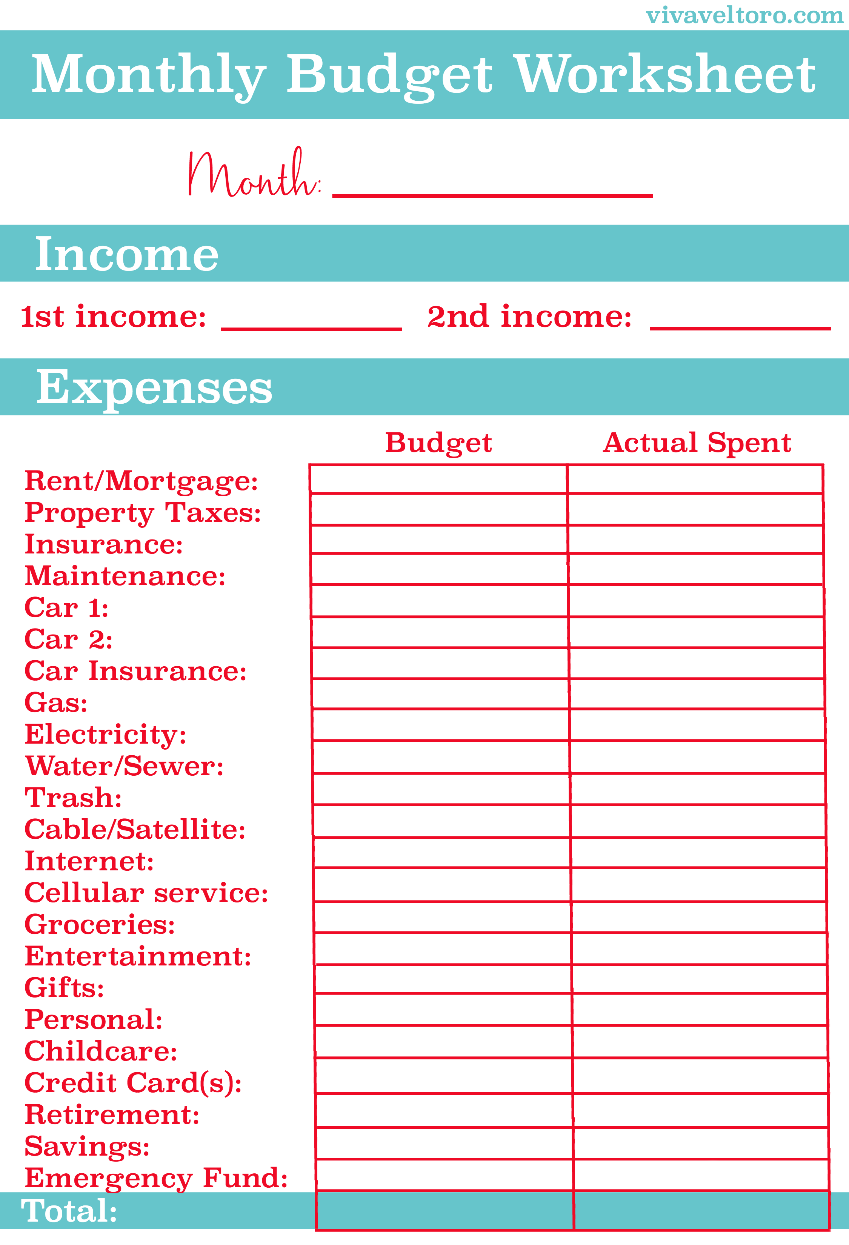

Here is a simple example of a budget:

As you can see, there is a column for Budget, and an Actual Spent column. This is to determine, if you actually keep to your budget, or do you overspend.

You can now fill in all the amounts that are applicable to you.

I would recommend that you put some money away (Savings) at the beginning of the month already. Put it in a different account or keep it in an envelope/piggy bank in a cupboard/drawer.

That way, if you do keep to your budgeted amounts, and you reach month end, you have that envelope/account with the saved money.

I hope you are able now to plan your money each month and to reach your next payslip without stressing about it.

South Africa

South Africa

Botswana

Botswana

Burkina Faso

Burkina Faso

Pallet

Pallet

There are no comments for this article